Who We Are

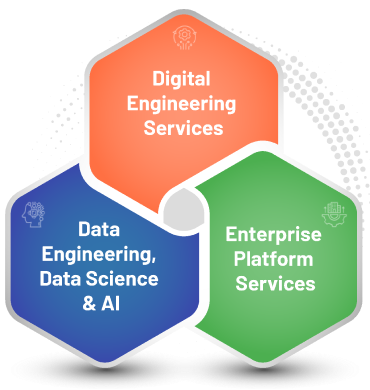

Acuity Knowledge Partners are market leaders empowering asset managers globally with cutting-edge AI/ML tools, comprehensive research, analytics and compliance solutions driving significant cost savings and operational efficiency. Partner with us to leverage our decades of domain expertise and innovative technology for sustainable growth and adaptability to evolving business needs. Let’s transform your asset management strategy together!

Our Asset Management

Footprints At a Glance

Sector Shifts Redefining the Asset-management Landscape

Segments We Support

Themes we could include here should be built around the overall asset-management landscape, technological developments in the sector, evolution of the sector over the years and key trends shaping the sector.

What You Can Do

Front Office

Improve investment

performance

Learn More

Attract new client assets

and retain existing assets

Learn More

Middle Office

Enhance

client servicing

Learn More

Reduce reputational

and financial risks

Learn More

Trending in Asset Management

Our Approach to Embracing Technology Responsibly

The asset management sector faces a number of technological challenges as it adapts to a rapidly changing landscape. Navigating these challenges requires a strategic approach and a willingness to embrace change and innovation. Challenges common to the sector include the following:

Integration with and transitioning from legacy systems

Regulatory and compliance-related issues

Data management and utilisation

Digital transformation

Cost and competitive pressures

Success Stories

Testimonials

Gaurav Medhekar

VP, Marketing Platforms & Performance

Sima Patel

Head of Digital Delivery

Awards

Acuity Knowledge Partners wins prestigious 2024 European Credit Award for Portfolio Management System of the Year

View more